Modern economies grow and distribute wealth based on investment decisions that fuel new developments. They provide money for businesses to grow and build infrastructure while supporting research discoveries and preparing people for better future prospects. This is particularly true in the Global South, where thoughtful investment could foster sustainable development, aid in poverty alleviation, and tackle major social and ecological problems. There are several investment strategies that address different financial objectives, but two are particularly distinct from the rest due to their diametrically opposing strategies: impact investing and traditional investing.

Building on literature, I elaborate on impact investing (Bugg-Levine & Emerson 2011; Geczy et al. 2021) and traditional/common investing (Bodie et al. 2021) which are in opposition to each other in the social focus sphere. Addressing social problems such as poverty, energy transition, and health care thoroughly while earning returns on investment is the goal of impact investing. On the other hand, traditional investing has an extreme focus on profit maximization. As the world becomes increasingly concerned with social responsibility, impact investing is gaining attention as a vehicle for economic growth in regions with extreme poverty and social inequities.

This piece shows why defining the purposes of these two types of investing is crucial for the development of strategic foresight in the Global South. Shall the Global South sticks to these two strategies or create a new investment approach for its development? The Sustainable Prosperity Investing (SPI) appears as an alternative which could ensure that economic progress does not remain to benefit only the investors.

Besides profitability, impact investing has a social and ecologic value. This type of investment modifies profit seeking opportunities into ventures that tackle global issues such as access to energy, healthcare, quality education, affordable housing, and sustainable agriculture. Impact investing aims to create wealth and change communities for the better at the same time. With increasing responsibility of social matters and financial growth, there is bound to be an equilibrating effect on the world and society as a whole.

Common investment, on the other side, is only focused on monetary value and wealth, completely ignoring social or ecological ramifications. Focusing solely on ROI and using a set of risk-adjusted parameters is the metric these investors operate on. Impact investment is unlike any traditional business. Pushes profit growth and expansion of the economy are done at the expense of social and environmental wellbeing.

Impact investors put their money in businesses and projects that are in sync with their overarching goal of bringing social and environmental change. For example, some of these investors fund initiatives which address climate change, provide clean drinking water, or work towards gender equity. Quite a few impact investors try to align their portfolios with the United Nations’ Sustainable Development Goals (SDGs) so that their financial choices don’t work against the world’s fight for sustainability and social equity.

On the other hand, traditional investors have a one-track mind focused on maximizing profits. Their purchasing of assets is only influenced by the current state of the market or how much profit it will bring. They tend to invest in companies and industries that are financially blooming. Unlike impact investors, they have little to no regard for the social benefits of the investment and consider economic success levels as the only metrics of importance.

As for the impact investors, success is determined not just by revenue but also by the social and environmental advantages their investments have achieved. For this purpose, they use the data driven tools such those from the Global Impact Investing Network (GIIN). In addition to normal profitability and growth measures, impact investors deepen the understanding of success using Environmental, Social, and Governance (ESG) criteria and policies, so that social responsibility, environmental sustainability, and ethical business practices are part of doing good business. This strategy gives them the freedom to make money while creating impact in the world.

On the contrary, conventional investors define success just in the lenses of revenue. Maximizing profit is done through other measures like ROI, value of assets, dividends received, and overall performance in the stock market. This approach, unlike any other, will not touch the social and environmental responsibilities of investing, which makes it particularly different. While traditional investment takes the most share in the market of investment, this type of investing minimizes impact on ethical reasons and makes profits the number one goal.

Impact investors must trade potential earnings to achieve their mission of positive social benefit. Impact funds demonstrate that you can achieve real benefits for society as well as market-beating returns. Greater awareness of sustainable solutions reduces risk for investors who support them.

Traditional investments work through financial market conditions and past performance results. Traditional investments provide varying levels of risk including government bonds and cryptocurrencies as well as startups but prioritize making money as their sole objective.

This chart shows the differences in risk and return for impact investing when compared to other common methods of investing. Traditional methods of investment sustain higher returns, but risk is quite significant, making them very unstable. On the other hand, impact investing improves financial returns and social responsibility, thus providing investors an easy ethically compliant option for creating wealth.

Impact investors are motivated by a vision that goes well beyond earning profit and uses their capital as a means to foster positive change. Be they individuals or institutions, private or public, they invest in areas that foster social inclusivity, environmental protection, and corporate responsibility. Their aim is to receive investment returns while making the world a better place.

In contrast, impact investing places its main focus in wealth accumulation for the investor’s sake, based on market activity, levels of risk involved, and anticipated profits. Their focus narrows down to getting the most profit without paying particular attention to societal or environmental responsibilities associated with their investments. Both impact investing and traditional investing aim toward financial profit, but the difference in motivation revolves around how society progresses in the realm of financing.

Impact investing is an approach that relies on short-term patience with a strategic vision of a long-term goal. Impact-focused initiatives set out to tackle social and environmental problems—two endeavours that always take time to pay off. Imbuing renewable energy to developing regions, facilitating access to education, and financing sustainable farming are all proactive steps toward achieving long-term goals.

On the other hand, conventional investors have the liberty of focusing on both short- and long-term strategies at the same time. Short term profits can be accrued through frequent buying and selling of stocks, while long term real estate investments and retirement plans ensure consistent appreciation as time goes on.

As more people try to solve environmental difficulties and social inequities through their financial decisions, impact investing is rapidly gaining popularity. This has been most pronounced among the younger generations, who are particularly keen to make value-based ethical investments. The industry is projected to exceed $1 trillion in value, according to the Global Impact Investing Network.

Meanwhile, traditional forms of investing remain the most popular due to their reputation for being safe and reliable. Financial markets are backed by a plethora of assets, including real estate, mutual funds, bonds, and stocks. This makes it simple for investors to accumulate equivalent wealth, which is why social or ecological objectives take a backseat.

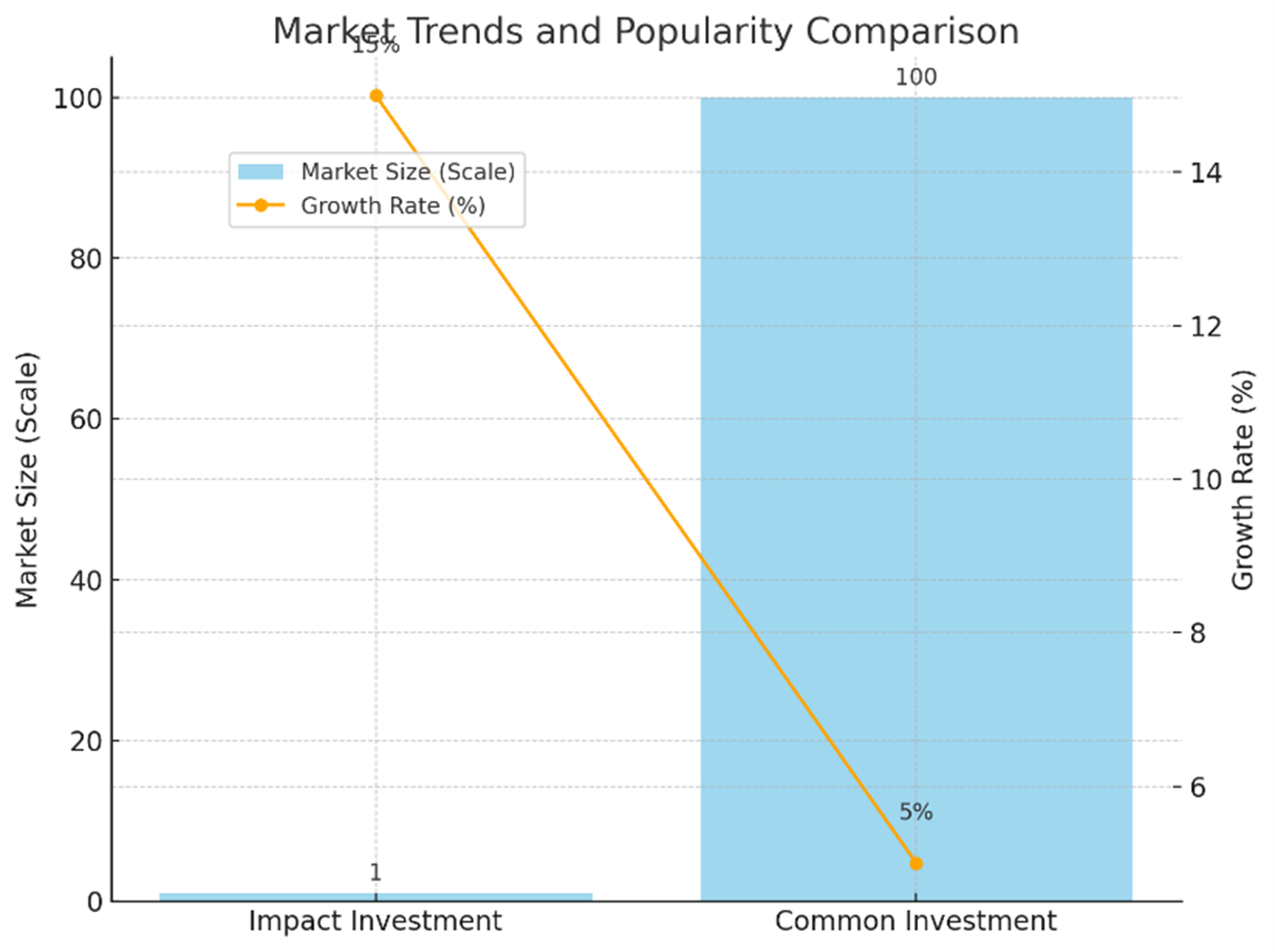

Bar Chart: Shows the total impact and common investment market quantities.

Impact investing works on an improved social impact that has a strong ethical rationale whilst earmarking money for social or environmental projects that are constructive in nature. It emphasizes impact as central to the investment rather than merely a consequence of it.

Contrary to this, traditional investments carry out their activities without any form of social responsibility incorporated within them. Such investments may support socially favorable industries while also allocating money to socially detrimental industries like fossil fuels, tobacco, or arms manufacturing. It is very evident that these investments do exist for the sake of profit with no intentions of fulfilling moral obligations whatsoever.

The implementation of impact investing in the Global South presents some challenges, like underdeveloped regulatory systems, poor financial infrastructure, and skepticism of scalability. Many developing economies lack comprehensive policies for socially responsible investment, which makes legal navigation a difficult task for investors. Furthermore, impact ventures often need advancing capital, which in most cases, these investors are not willing to offer because of their focus on short term returns. To solve this, governments and financial institutions need to improve the existing policies, create relevant impact measurement metrics, and facilitate collaboration among local businesses, foreign investors, and international development organizations to foster impactful development.

While more established, traditional investment in the Global South is also prone to facing issues concerning political volatility, exchange rate movement, or underdeveloped domestic financial markets. There is always a degree of uncertainty embedded in an economy and governance, which makes it difficult to persuade investors to put their money to work. To help boost the confidence of investors, it is essential to work on the legal and regulatory framework that guarantees financial disclosure, provides sufficient legal cover, and promotes investment in the region under long-term developmental perspectives. By enhancing the level of understanding people have towards finance and providing motivation to invest, governments will be able to ensure that both local and foreign investors are willing to funnel capital to the economy with the guarantee that it will grow sustainably.

Common investing and impact investing serve different purposes and target different types of investors in today’s financial system. Impact investing shows investors how to align their financial strategy with their commitment to making the world a better place. These investments emphasize a dual focus: They generate positive impact for society and the planet while generating regular returns. Values-driven impact investing uses resources to invest in projects that address major global issues, including global warming and access to healthcare.

Common investments help people build wealth while achieving financial gain. Their recurring money-growth opportunities help build a solid foundation for national and global economic improvement. Collaborative investments are essential to the functioning of global financial markets because they support business innovation while enabling individuals to secure their finances. Those who seek maximum returns through investing tend to choose traditional assets like stocks and bonds regardless of their impact on society. An investor’s choice between impact and standard investing reflects their core values and financial goals, as well as their impact. Standard investing dominates investment markets because it is easy to use and quickly measurable, while impact investing is accelerating as people around the world better understand how wealth can drive positive change. Millennials and Gen Z are leading this shift toward impact investing because they value investments that align with their values and help build a better future.

However, in the Global South, where economic development and social progress must go hand in hand, relying solely on one approach may not be sufficient. I propose a hybrid approach that combines both investment types under a “Sustainable Prosperity Investing (SPI)”, which emphasizes the ethical achievement of social and environmental goals along with financial profit. This SPI offers a new approach that ensures financial returns while delivering societal value over time. By using impact-focused investments alongside traditional investment approaches, the Global South can achieve sustainable economic development while still making profits. This combination will help ensure the financial resources are available, encourage investment from different regions, and enable sustained development in the future, ultimately creating a strong financial system that serves everyone.

This article examines how the illicit smuggling of critical minerals...

This article argues that poverty and uneven development in the...

This article explores how the Global South is reevaluating its...

This article examines the challenging path for Indonesia to meet...

This article analyzes Nigeria’s attempt to convert carbon credits into...

This article examines how Indonesia’s MBG program, while reaching more...

This article critically analyzes the 17th BRICS Summit communique, highlighting...

This article explores what Indonesia’s upcoming Digital Rupiah can learn...

This article explores how Indonesia can transform its steady economic...

This article discusses how global ESG standards, mainly created within...

This article explores Indonesia’s resilient people-based economy, driven by 65...

This article examines Indonesia’s 2025 economic turmoil, marked by a...

This piece explores how Pakistan can harness its rich cultural...

This incisive piece unpacks the deeper logic behind Trump’s so-called...

This article introduces Sustainable Prosperity Investing (SPI) as a hybrid...

This article examines how globalization challenges the authority of Islamic...

This article examines Danantara, Indonesia’s recently launched sovereign wealth fund...

This article explores how digital payment systems are reshaping financial...

This article explores the expansion of Islamic banking beyond Muslim-majority...

This article examines the impact of Trump’s aid cuts on...

Nestled within the Singapore-Johor-Riau Growth Triangle, Bintan Island has quietly...

While ASEAN’s regional integration is often framed through grand political...

Leave A Comment