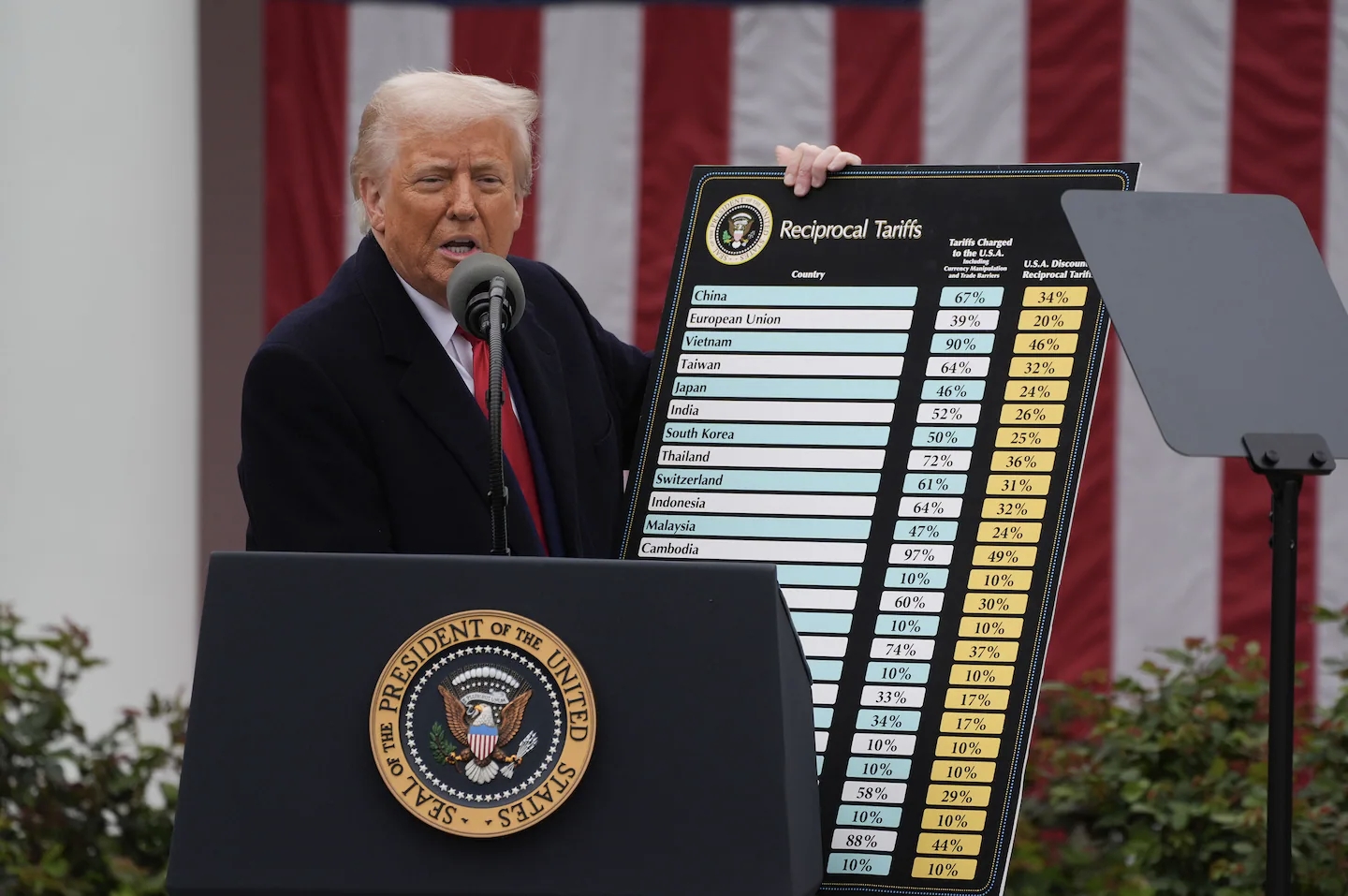

On April 2, 2025, President Donald Trump announced the tariffs that jolted global markets on a day he termed “Liberation Day”: tariffs of 10% on all U.S. imports that took effect on April 5, reciprocal tariffs of up to 49% on such countries as Cambodia that will go into effect on April 9, and an additional 25% auto tariffs (when applied to foreign autos) that started on April 3. However, the move is occurring at a time when America's goods trade deficit was US$1.2 trillion per Bureau of Economic Analysis (BEA) data in 2024 and will level the playing field that has for long lopsided to the detriment of America's interests but to the favor of America's trading partners. This is more than just another policy; this is an unfiltered raw deep expression of America’s frustration with a global order it once shaped but now sees it as unfair. Yet, now as the dust settles, the implications for the U.S., the world and most earnestly for the Global South are of a rich tangle of courage, mistakes, and unintended consequences. Five days in, the economic fallout, political fallout and human fallout suggest that all this comes at the back of a policy as disruptive and as bold as it is. This is a calculated risk for the U.S., but an existential threat for the Global South. The world watches, and the stakes demand a rethink.

America’s High-Stakes Bet

At its essence, the tariffs Trump implemented exist as an unfettered expression of his objections toward decade-long trade imbalances and his belief that America has endured exploitation from other nations. The tariffs promise fiscal, as well as industrial gains. The Tax Foundation predicts that tariffs will generate US$290.4 billion in revenue for 2025 which equals 0.95% of GDP thus relieving some pressure from the nearing US$2 trillion federal deficit. The April 2nd Tariffs will raise US$1.8 trillion in revenue over the next decade and if added to previously announced tariffs, which will raise US$1.3 Trillion in revenue over the next decade. In total, Trump’s tariffs will raise nearly US$3.2 trillion in revenue over the next decade and reduce US GDP by 0.8%. In the first term of Trump, steel tariffs had cut imports by 33% (one-third) and helped generate US$15.7 billion in investment, although a broader stroke could bring in the investment in other sectors. A 2024 study conducted by the Coalition for a Prosperous America (CPA) , which was pointed to by the White House, says that a 10% global tariff could create 2.8 million jobs, grow the economy by 728 billion dollars as well as increase real household incomes by 5.7%. The appeal is clear for a nation where manufacturing employment has been stagnant since 2000. As a result, the notion of 'Made in America' has an appeal in Rust Belt towns where factories used to stand silent.

Yet the cost is steep. The predictions from the same Tax Foundation analysis project a 0.8% slump in U.S. GDP before foreign retaliation, a possible wound that could even get worse as trade wars escalate. Households could be taxed on average US$2,100 dollars or more in 2025, a very bitter pill to a populace Trump repeatedly pledged to uplift. The current inflation rate which stands at a stubborn 4.3% is expected to increase due to rising import prices: Target and other retailers have already started to raise prices on Mexican farm products, a taste of what is to come. The Cato Institute is one of a number of free-trade advocates who claim trade deficits reveal savings imbalances, not unfairness, and warn of what it considers a heavier consumer pain than job gains. The stock markets have also been reacting negatively: The S&P 500, the stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States sank over 10% in two days, the worst since March 2020 wiping about US$5 trillion in the stock market, the tech-heavy Nasdaq confirmed it was in a bear market after fallen 22.7% from its December 16 record close as investors fled riskier assets on the tariff worries, and Dow Jones Industrial Average, a stock market index of 30 biggest and prominent companies listed on stock exchanges in the United States plunged 2,231 points, or 5.5% Friday April 4th continuing its slump from April 3rd. This is a market dread. It is not a liberation, as Trump called it, but a gamble with America’s economic soul.

If America’s pain is self-inflicted, the Global South’s is a wound dealt by a distant hand. This is because for developing nations, the tariffs are a hammer blow. Such emerging economies in the region face high reciprocal tariffs like Vietnam (46%), Indonesia (32%), Thailand (37%), Sri Lanka (44%), Cambodia (49%), and even impoverished Lesotho (50%) who are very highly dependent on export-led growth face a reckoning. These countries, some part of what US Treasury Secretary Scott Bessent calls the “Dirty 15” driving America’s trade deficit, are not titans like China or the EU. They are like fragile seedlings which their development has been painstakingly nurtured through decades. For instance, the import tariff will affect about 1.4%–2.0% of GDP, almost US$ 28.5–37.5 billion worth of Vietnamese exports. Cambodia’s US$14 billion textile trade faces a similar fate. The tariffs could also fray an apparel hub in the making, Ethiopia’s US$2.98 billion garment trade lifeline. For Sri Lanka, reeling from a 2022 debt crisis, this is a body blow to an economy where exports to the US exceed 23%.

The human cost is immediate. In Cambodia, there are 800,000 garment workers (75% of whom are women), families that mostly rely on US$200 monthly wages. Under the proposed 49% tariff, half such jobs would proceed to idle within a year, leaving millions mired in poverty. On April 3, the IMF’s Kristalina Georgieva sounded note of a “significant risk” to global growth, presently projected to be sluggish at 3.3% for 2025. For the Global South, the effect is not a slow down, but a derailment. These are not outliers: the Global South’s export led model that has pulled 1 billion plus from poverty since the 1990 which is mainly based on demand in the U.S., will be reversed with little effort, as export markets dry up and other debts grow. These countries lack leverage, so retaliation is not an option. Quite simply, the U.S. risks unraveling decades of so much growth and development for marginal domestic gain.

Trump's trade restrictions extend outside the Global South to break existing global regulations already on life support which is facing severe decline. A 34% new tariff topped off with 20% additional for earlier fees, amounts to a total of 54% slapped on China, which threatens reprisal countermeasures tariffs of 34% on all US goods and curbs on export of some rare earths, deepening an escalating trade war. As the EU prepares to respond to a 20% duty with a steel tariff, Macron considers suspending U.S. investment. But Japan, hit with 24%, chooses negotiation over retaliation as its Nikkei 225 fell 2.75% on April 4th. Canada faces worse already in a tit for tat spiral of 25% tariffs on US$20.6 billion in U.S. goods, with Prime Minister Mark Carney not mincing his words about the auto industry levy being a “direct attack” against it.

Presently we find ourselves within a massive worldwide economic brawl rather than a formal trade conflict. The IMF warns that trade volumes would take a ‘devastating blow’ and global growth is projected at 3.3% both in 2025 and 2026, below the historical (2000–19) average of 3.7%. That could be cut to one or worse in a full blown conflict. Although the U.S. taking of 14.6% (US$413.7 billion) of world imports as at 2022, is far from irreplaceable, the EU’s deal with Mercosur and the UK’s Pacific free trade deal point to a pivot that is mutually beneficial to both parties. Yet the chaos benefits no one. Just one day later, April 3rd, the world economy crashed as his tariffs sparked a global trade war, shook global markets to their core, shattered alliances, and shook to the future itself. The slump in the global market also extended to April 4th. We are teetering on the edge of recession, and the Global South, which is least equipped to handle it, is presently at the forefront.

Trump’s gambit is not without merit. What it reveals is a truth not sufficiently acknowledged: the global trade system is not even. According to data from the World Trade Organisation (WTO), the U.S. imposes average tariffs ranging from 2-3%, the EU those from 2-5%, and developing countries more than 13%. Non-tariff barriers: Japan’s auto standards, China’s subsidies tilt the field further. There is an echo to Trump’s “golden rule”: treat us as you would like to be treated. This bolder stroke would re-shore more, and his first term steel tariffs cut imports by a third and sparked a manufacturing flicker. This is an expression of self reliance that touches the heart.

However, at times the attributes of courage transform into silly choices. The reciprocal tariff formula trade deficit divided by a country’s exports to the U.S. is a blunt axe, not a scalpel. Ignoring scale, capacity and intent to adjust, it punishes Cambodia for its US$16 billion surplus as harshly as China for its excess of US$400 billion. The United States–Mexico–Canada Agreement (USMCA) offers no such exemptions for allies like Canada, why not be merciful to Vietnam, a U.S. ally against China? Russia , Belarus, North Korea and Cuba were also exempted and yet the uninhabited Heard and MacDonald islands were slammed with 10% tariff. Why? Because they are under Australia's authority? Maurice Obstfeld, C. Fred Bergsten, Senior Fellows at Peterson Institute for International Economics (PIIE); summarised it as just a way to exchange trade deficit: "because the tariffs are variable, consumers can shift to purchasing products from countries with lower tariff rates, and companies in higher-tariffed countries can reroute or invest in the lower-tariffed countries to get their products to the US. The US trade deficit with the lower-tariffed countries would actually grow. It’s like Whack-A-Mole.” With little to no negotiation, the announcement of the policy's hast reveals an America that fancies itself invulnerable and unwittingly risks trying to push away precisely the world that it cannot afford to lose at present. Word of history hisses: The Smoot Hawley’s 1930 tariffs made the Great Depression a deeper stink. Trump bets the world has changed. Has it enough?

The path ahead demands neither capitulation nor escalation, but a radical rethink. There are three steps to temper the chaos. The first thing the U.S. needs to do with tariffs is wield them as a scalpel, not as a sledgehammer. How? By reducing the tariffs for big emerging economies like Vietnam, Cambodia, Thailand, Indonesia, Philippines, and Nigeria. Why? Because most of them are US Strategic Partners and the high tariffs would just collapse most of their economies. Also remove the tariffs for low income economies and for others whose economies were ravaged by war like Lesotho, Madagascar, Myanmar, Congo DRC, Ethiopia, Laos, Syria, Sudan, Gambia, e.t.c. Combine that with a US$100 billion package of infrastructure loans (to fund roads, railways, power generation and utilities needed for economic development), not aid, financed by tariff proceeds to help them become more resilient, like the World Bank US$18 billion loan support to Turkiye’s economic reforms in 2023. Think infrastructure, not handouts. Through this the US can both reduce Chinese Influence and also induce the countries to reduce/remove their US import tariffs. Second, the United States should negotiate and also establish mutually beneficial bilateral diplomatic agreements with major powers like China and the EU where they would receive reduced tariffs in exchange for expanded market opportunities. For example, The U.S. wants EU cars, and the EU wants US Liquefied Natural Gas (LNG) imports up; let’s strike that deal. A third essential change should be to transform the World Trade Organisation (WTO) into a forum with actual enforcement power against tariff barriers by rebuilding its dispute settlement body before 2026 while offering trade concessions as a compliance incentive; a great multilateral fix Trump could champion.

For the Global South, survival hinges on agility. Global South nations should focus not only on China but other markets like India where the economy has grown by 9.2% in the financial year 2023-24 and other big markets like Vietnam, Indonesia, Brazil, Mexico, and a host of others or they can intensify South-South trade where the trade more than doubled from US$2.3 trillion to US$5.6 trillion between 2007 and 2023, signaling new opportunities for developing economies through regional blocs such as ASEAN, ECOWAS e.t.c. The debt relief agreement similar to the one obtained by Sri Lanka in 2023, needs to happen quickly for other struggling economies as the IMF has a capacity of lending of about US$932 billion as at 2023 that remains untapped. The United States should play the role of a great partner not a bully by leading in this situation in partnerships which combine economic protection through tariffs with substantial financial support, if Trump can acknowledge that. The world does not have to fracture, it can get into rebalance.

Trump’s tariffs are more than a policy, they are a mirror of a trade system that works today based on asymmetries; selective fairness; and long time unresolved grievances. The tariffs deliver a very bold resistance against years of international trade imbalances and inequities while also presenting a dangerous oversimplification of a deeply interconnected world.The April 2 measures were meant to reset the scales. Instead, they may rupture them entirely.

In the short run, such dual realities bring the United States increased tariff revenue, a potential revival in domestic manufacturing and a symbolic statement of sovereignty, all of which are real but relatively limited. But that pain is shared: consumer cost is rising, markets are rattled and loyal economic and diplomatic alliances that sustained global stability are fraying. Even for the architects of the policy, it is a gamble with the American consumer’s tolerance, the markets’ confidence, and the economy’s resilience.

For the Global South, it is more a sentence, rather than a gamble, and one handed down without negotiation. These tariffs are not hitting the economic giants capable of retaliation, but fragile economies on the verge of progress. Export market loss is not only GDP shrinkage but it means unemployment, social unrest and millions thrown back into poverty.

For the global economy, this is a very dangerous inflection point, a massive turnaround to economic nationalism that could write off the progress in integration that has taken decades. The global economy, more and more broken into camps and competing spheres, would become more likely to weaponize trade and more likely to redevelop alliances based on raw national interest.

But the crucible has yielded a choice. America has a right if not a duty to question what amounts to a system that no longer works equitably for its people. At the same time, it bears the weight of being the world's economic anchor. It needs a path to go toward; one where American strength is not declared but is further shared, in which tariffs are instruments of balance, not instruments of wrath. A path back to fairness that redefines trade, reinvents trust, and reimagination of globalization for this new world.The lesson here is that there is no winner in a zero sum global economy. Tariffs may hold America up in the short term, but it is real leadership that builds systems of mutual prosperity, not fairness procured at others’ expense. The global order is broken, but it must be reformed, not retributed.

This is not Liberation Day; it’s Judgment Day for trade and for all other values that we choose to defend in this fast changing world. Whether this episode will be a footnote in an era of division or a great turning point to a more just and more inclusive global economy, depends on what the world and America chooses next. The real verdict is still being written.....

This article examines how the 2025 recognition of Palestine by...

This article shows how the United States’ 19% tariff on...

This article reflects on the Thailand–Cambodia border dispute, capturing it...

This article examines how the absence of coordinated trade negotiations...

This article explores the strategic implications of the Indonesia–Turkey defence...

This article reveals how Hungary, a country that is frequently...

This article examines how a leaked phone conversation between the...

This article examines the 2025 border crisis between Thailand and...

This article explores the deep-rooted and multifaceted rivalry between Israel...

This article critically examines the U.S.–Israel strike on Iran’s nuclear...

This article examines how China is navigating its strategic partnerships...

This article explores how the Red Sea crisis, escalated by...

This article takes a critical look at how Prime Minister...

This article looks at how Malaysia under Anwar Ibrahim is...

This article exposes how over one million Rohingyas stripped of...

This article examines how President Trump’s recent Middle East tour...

This article challenges Indonesia’s and much of the Global South...

This article explores how global trade policies affect women’s labor,...

This article reevaluates the outcome of the Syrian conflict, arguing...

As the shift to clean energy intensifies, resource-rich nations in...

This article examines the 2025 Pahalgam massacre of 26 pilgrims...

This article explores the April 2025 Pahalgam massacre as a...

This article examines the ongoing war in Yemen as a...

This article analyzes Indonesia’s strategic hedging in the Indo-Pacific, spotlighting...

Leave A Comment